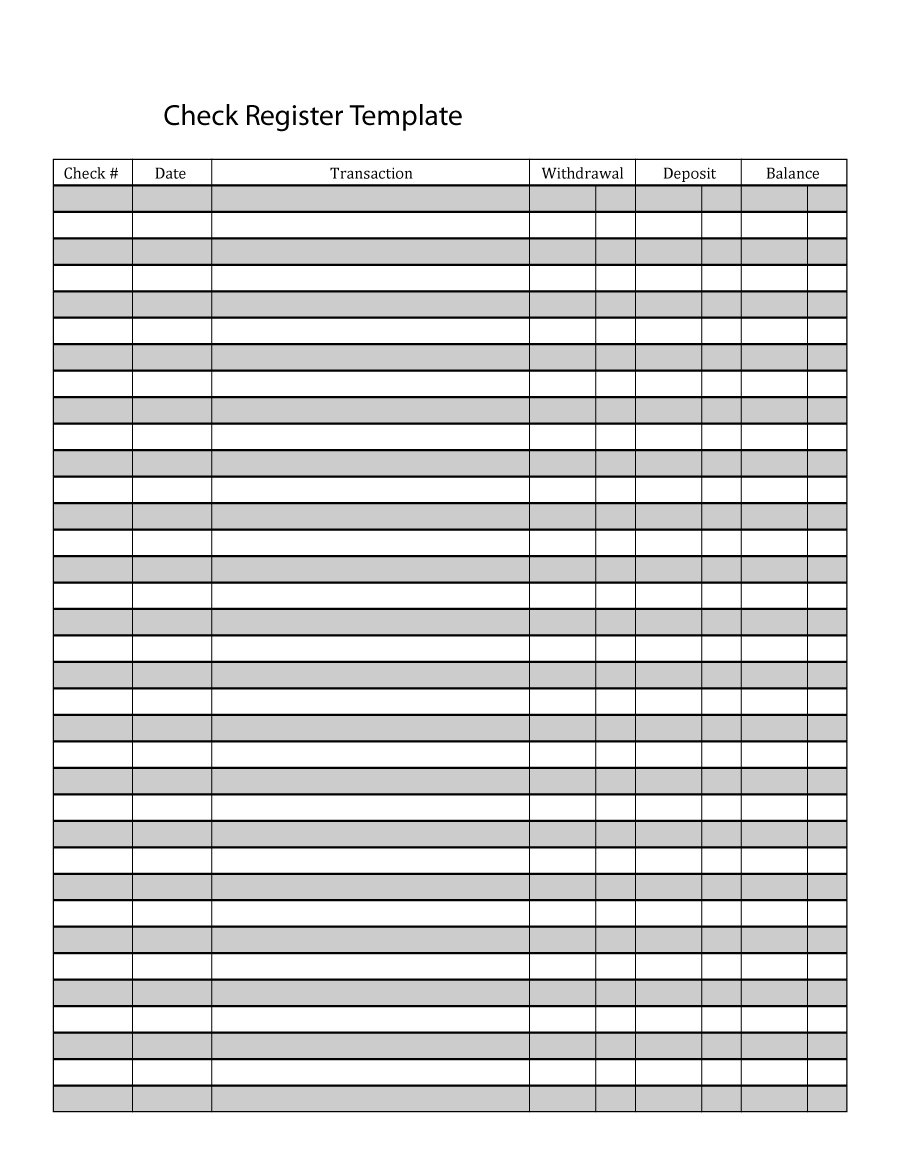

This is one of the most important parts of your register. If you own two or more accounts and you want to move a certain amount of money from one account to another, you must write the exact amount that you transferred to the register. This refers to the money you deposited under your account through the check. Make sure that this charged fee amount appears in the check’s register column. This charge isn’t associated with the transaction or the bank. For example, if you withdrew money through an ATM, you will get charged a minimal fee. This refers to the amount that you incurred because of the transaction. You must also write the exact and complete amount. This refers to the amount of money you took from your account. Make sure that you write down the exact amount in this section, whether you have made the payment using your credit card, debit card or through an online transaction. This refers to the amount of payment you write on your check. In most cases, you will write the description with the recipient’s name. You can provide any name as you deem fit. This determines to whom you issued the check. Remember that the person for whom you’re writing the check for might not get the amount in the check should an error occur. Always make sure that when you write the date, it is the correct one. This refers to the date when you issued the check. You can just write the number of the check in your checkbook ledger to make sure that you’re not missing any checks. Here is the information you must include in your printable check register to make it efficient:Ĭheck booklets have check numbers arranged chronologically and as such, poses no harm even if an error or a mistake occurs. Almost all registers contain similar information. What to include?Įvery time you issue a check, you must record this in your check register template.

With a check register, you can find these errors and have them rectified. There can also be instances, although rare, that banks commit mistakes. Moreover, the register also serves as a “checker” for your spending habits since you will have no choice but to see what you’re spending your money on and how much of it you have left. If you can maintain a check register template for your business, you can have the assurance that you will always stay updated in terms of your financial status as it will give you updated information about your spending habits. An individual or a company can easily refer to the register when making necessary decisions as it emphasizes the actual picture of investments and expenditures. Usually, you can turn to your check register to determine your checking account balance as it contains the disbursements and all of the transactions associated with your account.Ĭorporate businesses can use this register to help management in the evaluation of how much cash the company used while keeping track of flows. In such a case, you can expect that your check register contains your name and a lot of similar descriptions. In most cases, you might find similar descriptions found in your register and this depends on the types of transactions and the types of people you’re dealing with.įor instance, if you are a businessman dealing with plenty of retailers. You would use a checkbook register before adding anything to your general ledger. Information contained in a check register include things like:

0 kommentar(er)

0 kommentar(er)